Notorious PLG 11.2.21

Weekly update email on the most important product-led growth ("PLG") companies

Current subscribers: 1,279

Notorious PLG Startup of the Week:

As all of our meetings have moved online over the last 18 months, it becomes draining and difficult to take notes while simultaneously performing on the video conference. Enter Grain. Grain is an automated note taking and recording application that captures the meeting and empowers users to create and share meeting highlights. There are many powerful use cases for Grain including product research, interviewing and training.

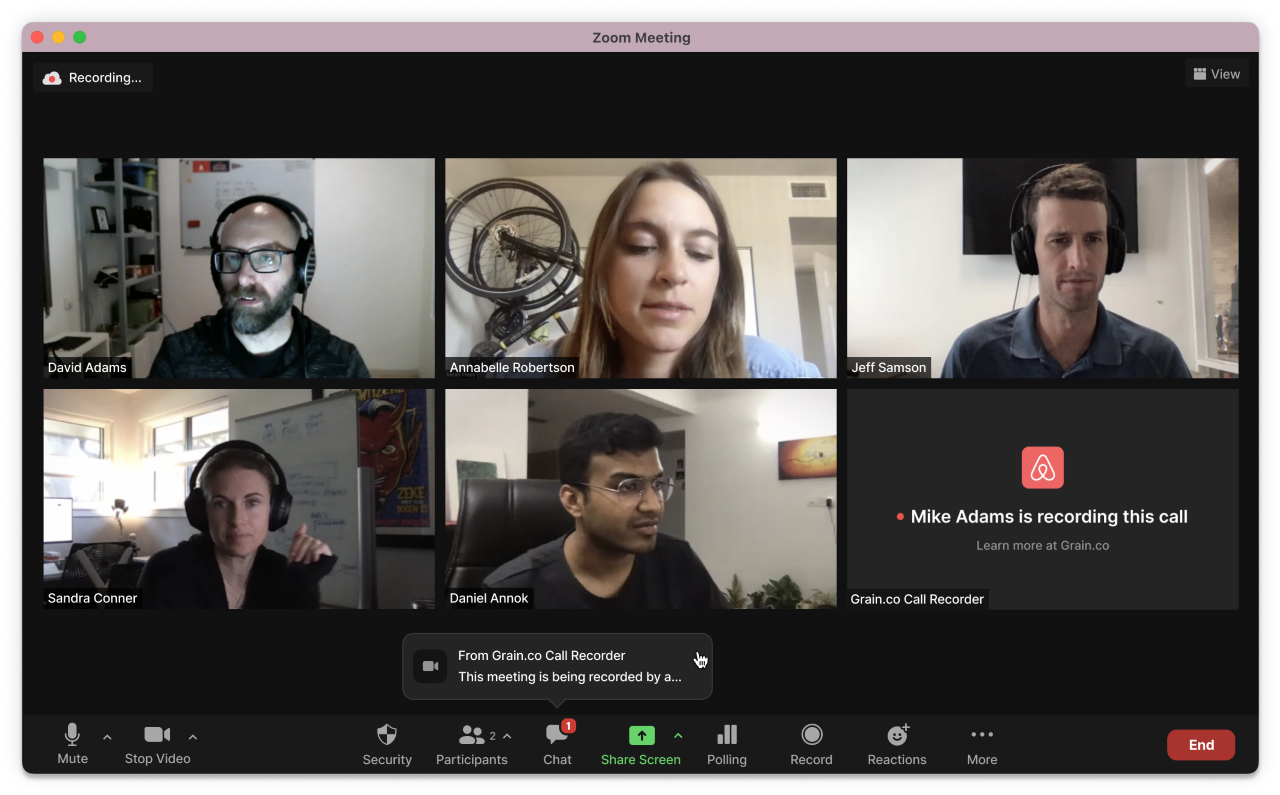

I first came across Grain when I was looking for an intelligent note taking tool. Grain is much more than that as it not only transcribes the meeting, but captures the video highlights as well. With video-based note taking, we can experience a much richer recollection of the meeting as we can observe body language and emotion. The Grain team has focused on product-led growth and thus has been able to spread quickly throughout organizations like Zapier, Vimeo and Atlassian. Grain is inherently viral as other meeting participants are alerted that the Grain bot has joined the session and the post meeting clips can be effortlessly shared with other participants. The holy grail for Grain is to automagically capture and the stitch together meeting highlights so users have a repository of everything that happened this week. With more accurate highlights from Grain, we will all make more informed decisions — based on evidence, not faded recollections — going forward.

For this edition of Notorious PLG, Mike Adams (CEO + Co-founder) shared his thoughts on PLG with me:

“We first discovered the opportunity behind Grain while building what may have been the first Zoom school in 2015. Every conversation was now digitally transcoded but we were not any smarter than when our conversations were analog in the in-person world. So we decided to record and manage access to every lecture, interview, and team meeting just to see what happened.

It changed everything.

Suddenly we could leverage all our recorded data to improve learning outcomes, reduce bias in admissions decisions, understand our customers, and keep our teams in sync. Even more surprisingly, our students started to take notes in the Zoom chat so they could go back to the timestamp in the recording where they were confused. Inside of our recording platform, they’d engage clip highlights, ask each other questions and engage more deeply with the content they were learning.

So after the company was acquired in 2018, my brother and I started Grain with a mission to make the recorded content of video meetings accessible and useful for every type of video conversation.

We knew from the start that product led was going to be the core growth driver three main reasons:

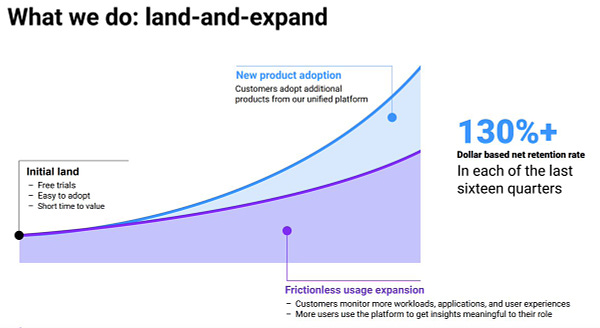

Grain is inherently a social product. We live it ourselves and our users experience it too. Grain media — highlights and stories you create using Grain — wants to be shared. Creators (i.e., users who record) clip and share the moments from Zoom with consumers. As such, Grain is different from traditional SaaS/Enterprise products which tend to "keep to themselves" inside dashboards and mobile apps. Grain was designed to implicitly make media available to external and much wider audiences.

Grain works for everyone. Every time you connect with someone using Grain, you’ll see their branded recorder as a participant — recording and transcribing — the conversation in real-time. But just exposing your product to someone else wouldn’t make any sense unless your product can work for them. Product and user research teams use Grain to capture and share the voice of the customer and research insights while Sales use Grain to repurpose customer calls to create assets and provide unbiased product feedback.

Grain organically lands and expands across the entire company without a sales touch. It has always been designed as a multi-player tool for teams, with the recorded content to be shared cross-functionally. A marketing team can learn how customers articulate a specific problem in their own words without ever talking to customers and the product team can get real-time market feedback from sales conversations on newly released features.

Put simply, our product led strategy is to make the process of capturing and sharing the important moments from video meetings as seamless as possible — which in turn drives existing users to share more Grain media and attract a cohort of new users who become content creators themselves.

Over the past two years of building and using Grain, we’ve been fortunate to learn from our own set of users including companies like Zapier, Vimeo, Atlassian, and ClickUp. To turn your teams conversations into shared content, try Grain for free.”

Please email any Notorious PLG of the Week suggestions to me at zach@wing.vc

PLG Tweet(s) of the Week:

If you were forwarded this email and are interested in getting a weekly update on the best PLG companies (private + public), please click this subscriber button below:

Recent PLG Financings (Private Companies):

Fellow: a collaborative platform for meeting agendas, action items, and feedback raised a $24M Series A led Craft Ventures.

QuickNode: a blockchain infrastructure platform raised a $35M Series A led by Tiger.

Attest: no-code application to build and distribute research surveys as a service raised a $60M Series B @ $270M post from NEA and Kismet.

Pipefy: a low-code workflow management tool raised $75M Series C led by SoftBank Latin America Fund.

Crossbeam: a partner ecosystem platform raised a $76M Series C @ $456M post led by A16Z.

Yugabyte: an open source distributed SQL database raised a $188M Series C led by Sapphire Ventures.

ClickHouse: an open-source, high performance columnar OLAP database management system for real-time analytics using SQL, raised a $250M Series B @ $2B post led by Coatue and Altimeter. This round came together a few months after the Series A that was led by Benchmark and Index.

Alchemy: a developer platform for blockchain and Web3 raised a $250M Series C @ $3.5B post led by A16Z.

ClickUp: an all-in-one place for tasks, docs, chat, goals raised a $400M Series C @ $4B post co-led by A16Z and Tiger Global.

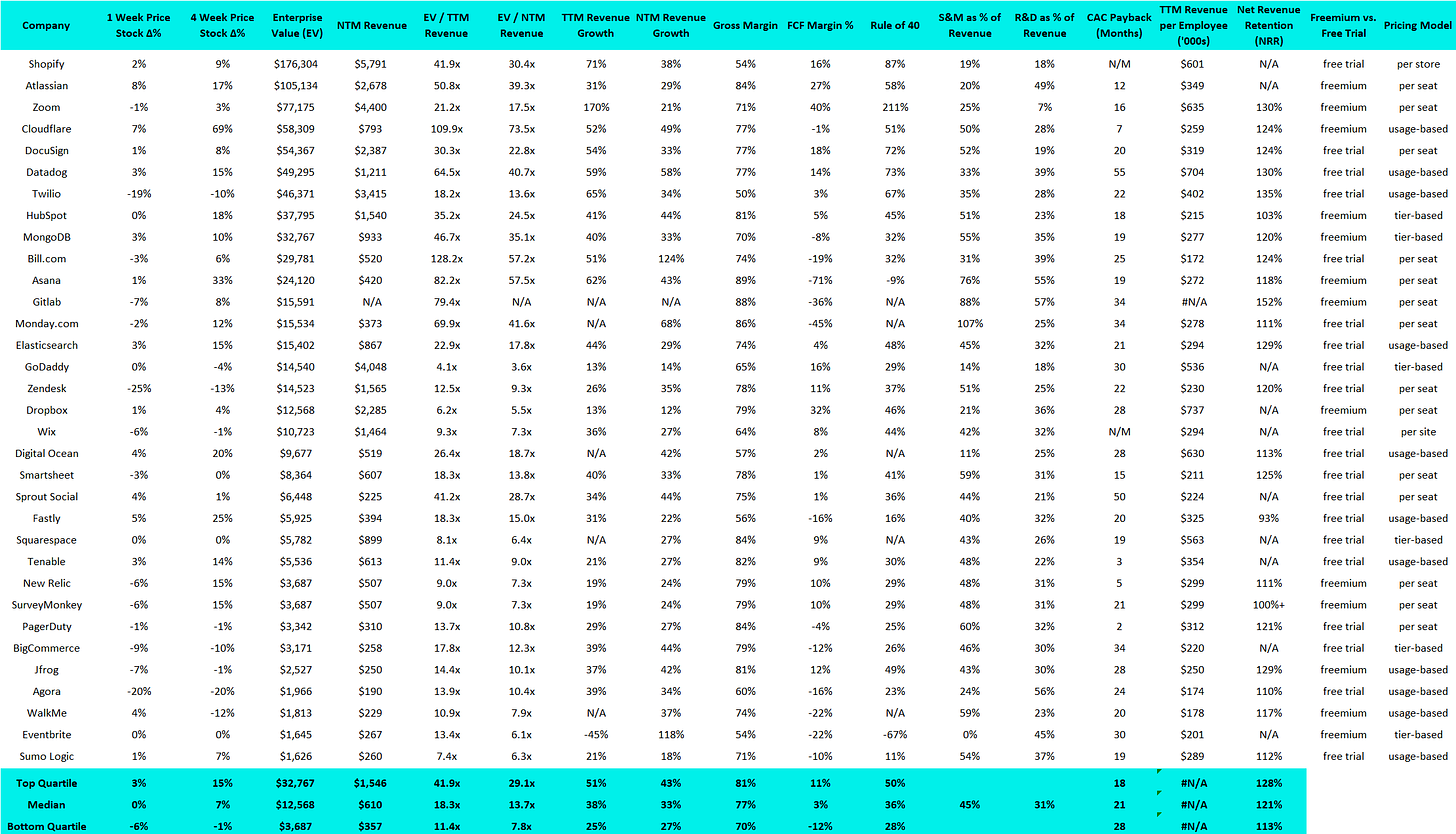

Recent PLG Performance (Public Companies):

Financial data as of Friday market close.

Biggest Stock Gainers (1 week):

Atlassian: 8%

Cloudflare: 7%

Fastly: 5%

Biggest Stock Gainers (1 month):

Cloudflare: 69%

Asana: 33%

Fastly: 25%

Enterprise Value / TTM Revenue:

Top quartile: 41.9x

Median: 18.3x

Lower quartile: 11.4x

Enterprise Value / NTM Revenue:

Top quartile: 29.1x

Median: 13.7x

Lower quartile: 7.8x

Rule of 40 (TTM Revenue Growth % + FCF Margin %):

Top quartile: 50%

Median: 36%

Lower quartile: 28%

Median % of Sales:

S&M: 45%

R&D: 31%

G&A: 20%

Net Revenue Retention:

Top quartile: 128%

Median: 121%

Lower quartile: 113%

GM-Adjusted CAC Payback Period (Months):

Top quartile: 18

Median: 21

Lower quartile: 28

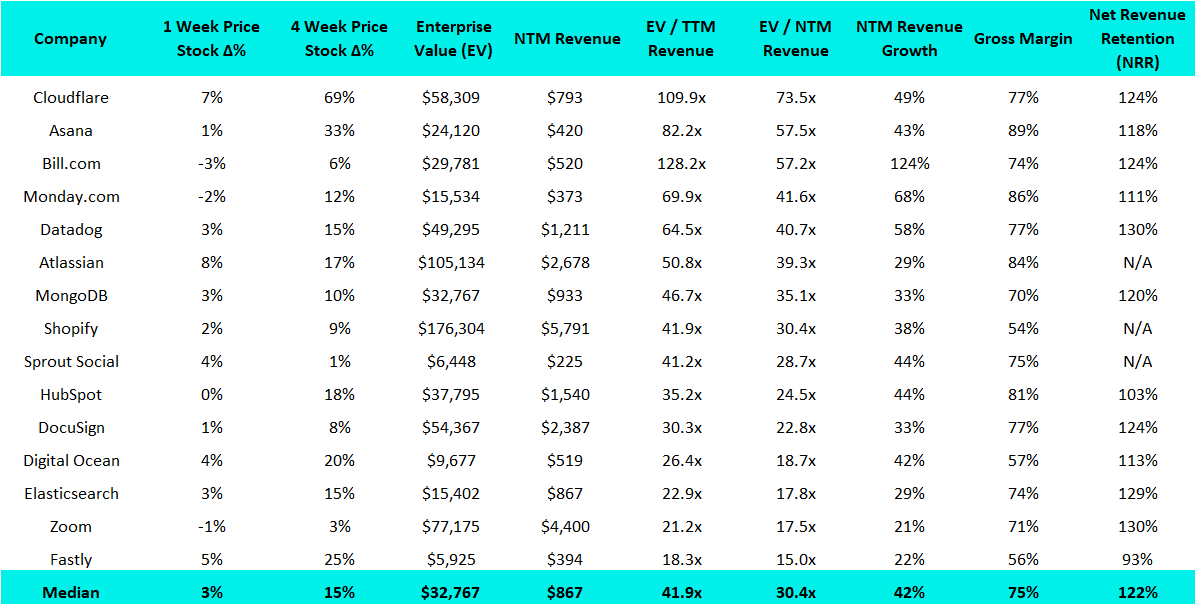

15 Highest EV / NTM Multiples:

Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12.