NPLG 5.18.23: PLG Dominates the Enterprise Tech 30

The best PLG founders, startups, strategies, metrics and community. Every week.

Current subscribers: 7,040, +60 since last week (+0.8%)

Share the PLG love: please forward to colleagues and friends! 🙏

NPLG 5.18.23: PLG Dominates the Enterprise Tech 30

It’s that time of year again. Wing Venture Capital (where I work) presents the 5th annual Enterprise Tech 30 (“ET30”). The ET30 serves as a platform for the tech industry to identify, learn about, and build relationships with top private companies in enterprise technology. The ET30 winners represent the most promosing private companies in enterprise technology, as determined by an exclusive research process with 96 venture capitalists on an invitation-only basis. This year’s winners by category (based on cumulative fundraising amounts) are:

Sorted by the tech stack:

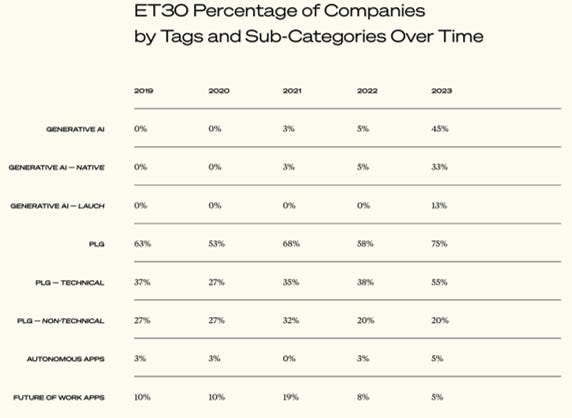

Product-led growth has taken a hold in the Enterprise Tech 30. This year, we refined our definition of product-led growth to include those companies with a primary or a core motion in self-serve. In previous years, we had included companies with any motion in self-serve. Admittedly, it is a difficult call in many cases, but the discernment yields more accurate insights on the levels and growth rates of PLG among startups. This year, 75% (30 of 40) of ET30 companies employ a significant product-led growth model, as compared to 63% of ET30 companies in 2019. Of the 30 PLG companies this year, 22 were technical PLG and eight were non-technical PLG. We define technical PLG in our framework as motions to technical adopters such as software developers, data engineers, and data scientists. Similarly, non-technical PLG includes motions to business adopters across management and functional areas.

I would love feedback. Please hit me up on twitter @zacharydewitt or email me at zach@wing.vc. If you were forwarded this email and are interested in getting a weekly update on the best PLG companies, please join our growing community by subscribing.

PLG Benchmarking (Startups):

This is a new section! I will continue to update these metrics and add new metrics. I would love your feedback on what else I should track.

Conversion rate (website → free user):

Best: 10%

Good: 5%

Activation rate (free user → activated user):

Best: 60%

Good: 30%

Paid conversion rate (free user → paid user):

Best: 8%

Good: 4%

Enterprise conversion rate (free user → enterprise plan):

Best: 4%

Good: 2%

3-month user retention (% of all users still using product after 3 months):

Best: 30%

Good: 15%

Conversion from website to free user:

<1 month on waitlist: ~50%

>3 months on waitlist: 20%

For more detail on acqusition rates by channel (Organic, SEM, Social etc), please refer to this prior NPLG.

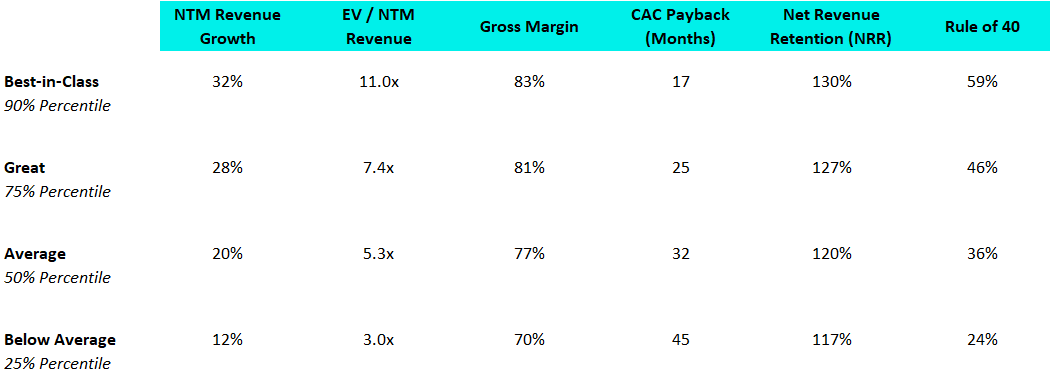

PLG Financial Benchmarking (Public PLG Companies):

Financial data as of previous business day market close.

Best-in-Class PLG Benchmarking:

15 Highest PLG EV / NTM Multiples:

15 Biggest PLG Stock Gainers (1 month):

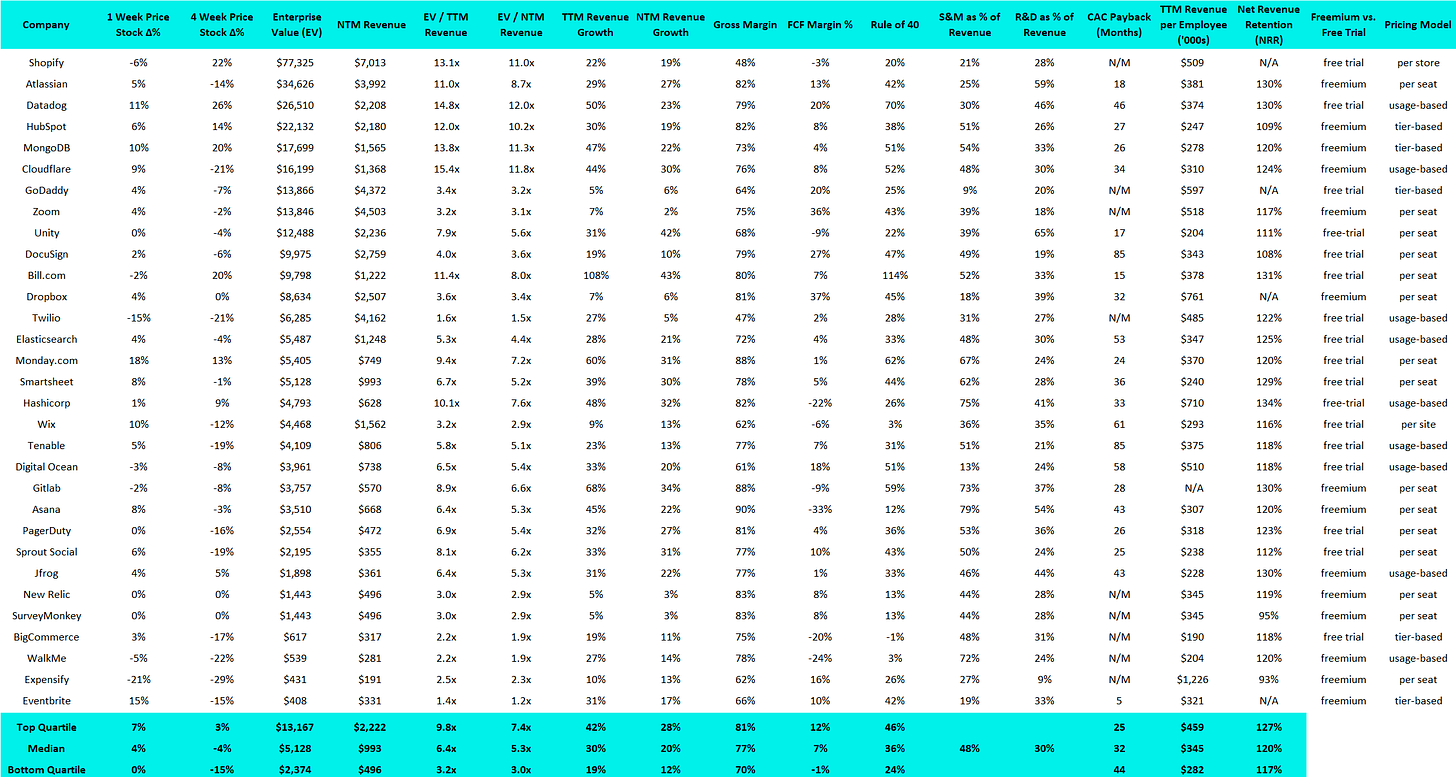

Complete Notorious PLG Dataset (click to zoom):

Note: TTM = Trailing Twelve Months; NTM = Next Twelve Months. Rule of 40 = TTM Revenue Growth % + FCF Margin %. GM-Adjusted CAC Payback = Change in Quarterly Revenue / (Gross Margin % * Prior Quarter Sales & Marketing Expense) * 12. Recent IPOs will have temporary “N/A”s as Wall Street Research has to wait to initiate converge.

Recent PLG Financings (Private Companies):

Seed:

AudiencePlus, an operator of a media company intended to offer content creation services, has raised $5.4M. The round was led by Emergence Capital, with participation from Forum Ventures, Work Life Ventures and GTMFund.

Granola, an operator of a context-aware workspace startup intended to develop a new kind of tool for knowledge work, powered by GPT-style Large Language Models, has raised $4.25M. The round was led by Lightspeed Venture Partners.

SquareX, a company that says it’s creating products tailor-made for browser-based cloud SaaS tools, has raised $6M. Sequoia Capital Southeast Asia funded the round.

Syncly, a developer of AI-powered bug-reporting tool designed to boost productivity by automating and streamlining the issue-reporting process, has raised $2.64M. The round was led by 500 Global, SoftBank Ventures Asia and Fast Ventures.

Series B:

Stardog, a developer of an enterprise knowledge graph platform intended to unify data in order to get the answers needed to drive business decisions, has raised $45.2M at a $195.2M valuation. The round was funded by Accenture Ventures.